Henry County, the local school district and three cities have property tax hearings during July 2023. Because of increased property values, each entity is expected to bring in additional collections over one year ago. In addition, Stockbridge is considering to implement a city property tax.

When property tax collections would increase, state law requires a local government to hold three public hearings. Each board will vote at their third and final hearing to approve the millage rate.

Property Tax Hearings 2023

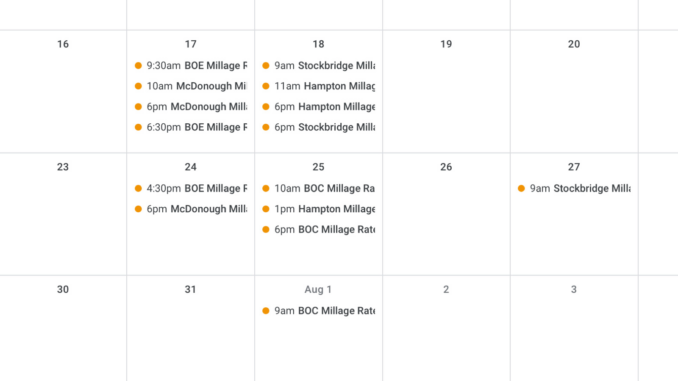

Below is the meeting dates and times for each local government. All meetings are open to the public.

Though the various boards have not yet approved their millage rates, the county and school board have adopted their annual budgets. Budget approval occurs in late spring for the upcoming year. The budgets assume no change in millage rate would be forthcoming.

Board of Commissioners

The Henry County Board of Commissioners presently levy 12.733 mills in unincorporated areas. This number has been in effect since 2016. City residents pay less in county taxes to reflect services their city provides. The board will have millage rate hearings on the following:

- Tuesday, July 25, at 10 am

- Tuesday, July 25, at 6 pm

- Tuesday, August 1, at 9 am

The board meets at the county admin building located on Henry Parkway in McDonough.

Revenue Projection

The county projects tax collections worth $89.8 million. This is an increase of $5.9 million from last year. It is worth noting the county has a frozen homestead exemption. This means homestead properties will see no change in the amount they pay in county taxes from year to year. The frozen homestead is expected to save homeowners about $35 million dollars this year. It does not apply to other portions of the property tax, such as the school district or a city.

Henry County Board of Education

The Henry County school board receives about 60% of property tax collections. They have levied 20 mills for operations — the maximum allowed by state law — since the mid-2000s. The district is proposing to maintain the 20 mills rate for 2023. In addition, HCS has a separate millage rate for debt services. Millage rate hearings will occur at the below dates and times:

- Monday, July 17, at 9:30 am

- Monday, July 17, at 6:30 pm

- Monday, July 24, at 4:30 pm

School board meetings take place at the district office. It is located at 33 North Zack Hinton Parkway in downtown McDonough.

Revenue Projection

In 2022, the school district received $228.4 million in local revenue. For 2023, they are estimating $249.7 million. This represents an increase in property taxes by 21.28 percent. With the increase in revenues, the school district has increased its base teacher salary by $7,000 in two years.

City Property Taxes

For many years, McDonough was the lone city to charge a property tax. Their residents paid a higher property tax rate than others prior to 2022. They also benefited as the only city to offer its own fire department. Beginning last year, two items occurred:

- McDonough was able to lower its city property tax rate below the county offset they receive. This means city of McDonough residents and business owners now pay taxes at a lower rate than unincorporated areas.

- Hampton levied a city property tax in 2022 for the first time since the 1970s. Stockbridge could soon join them by implementing a new property tax.

Each city above must hold public hearings to set their millage rate. The fourth city, Locust Grove, does not levy a property tax.

McDonough

The city of McDonough intends to maintain their current millage rate, 3.033 mills. Doing so will bring in $5.5 million in tax collections. This represents an increase of about $1 million dollars, or 23.87%, from last year. Their millage rate hearings will be at the following times:

- Monday, July 17, at 10 am

- Monday, July 17, at 6 pm

- Monday, July 24, at 6 pm

Meetings occur at McDonough City Hall.

Hampton

Last year, Hampton implemented a city property tax valued at 4.5 mills. They are tentatively planning to maintain the same rate. This will increase their tax collections by about $409 thousand, or 33.67%. Collections would total $1.6 million. Millage rate hearings will occur on the dates below:

- Tuesday, July 18, at 11 am

- Tuesday, July 18, at 6 pm

- Tuesday, July 25, at 1 pm

Meetings take place at Hampton City Hall.

Stockbridge

Finally, the city of Stockbridge is considering to implement a city tax. This would help pay for city services like their police department, public works and bond debt. The city is advertising a tentative millage rate up to 6 mills. Based on discussions in May, the final millage rate will likely be closer to 3.7–4 mills.

A property tax valued at 6 mills would produce $10.9 million dollars in collections. Four mills would collect about $7.3 million. Without any city tax, their annual budget has a $6.8 million dollar shortfall. Millage rate hearings are as follows:

- Tuesday, July 18, at 9 am

- Tuesday, July 18, at 6 pm

- Thursday, July 27, at 9 am

Meetings take place at Stockbridge City Hall.

Featured image shows the property tax hearings calendar for July 2023. Special photo.

Support Local Journalism

Subscribe to MHF News and support local journalism in the Henry County community.

You will receive access to all of our news articles.