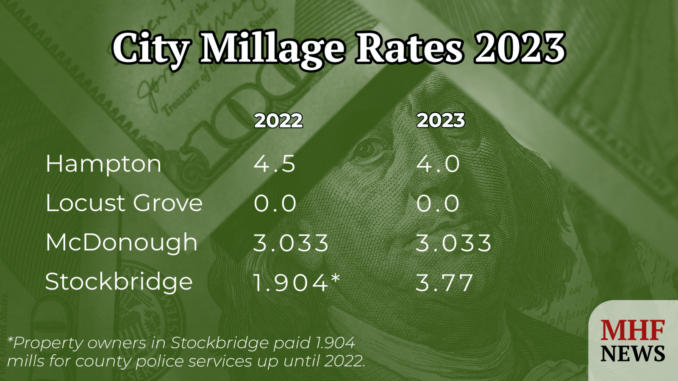

Local cities in Henry County have now concluded their millage rate hearings for 2023. Three cities will levy a property tax this year, up from two cities a year ago.

City Millage Rates 2023

For 2023, the cities of Hampton, McDonough and Stockbridge will each levy a millage rate. The city of Locust Grove does not levy a millage rate. Each city also receives a portion of sales tax revenue to help pay for their budget.

City property taxes pay for municipal services such as the police department and public works. In addition, the city of McDonough staffs a fire department.

First, the city of Hampton will levy 4.0 mills. Last year, they charged 4.5 mills. Though they reduced their millage rate, it will bring in more tax collections than one year ago. This is due to increased property values. Hampton estimates to collect about $1.44 million in property taxes, up from $1.21 million in 2022.

Secondly, McDonough will be maintaining a 3.033 millage rate. They have had a property tax for a number of years. The tax will generate $5.5 million, compared to $4.5 million one year ago.

Finally, Stockbridge approved to levy 3.77 mills. This will be the city’s first property tax since 1977. The tax will generate an estimated $6.8 million.

Though the city tax is new, property owners in Stockbridge will see a reduction in county taxes. This is because Stockbridge residents were paying 1.904 mills for county police services through 2022. As a result, the net rate change is less than two mills.

One mill is equivalent to $1 in taxes per one thousand dollars in accessed value. Georgia accesses property at 40% of its appraised value.

Homestead Exemptions

Homestead exemptions can provide tax savings for homeowners. The process to create them requires legislative approval at the State Capitol and a voter referendum. Last year, Locust Grove voters approved a homestead exemption for their city. It will apply should Locust Grove need to levy a property tax in the future.

This November, Hampton city residents will vote on several homestead exemptions. If the voters approve them, then the tax savings would begin in 2024.

In addition, the Stockbridge council asked city staff to present options to request a homestead exemption. The earliest Stockbridge could see a homestead would require legislative approval in spring 2024 then a voter referendum in Nov. 2024. Tax savings would then occur starting in 2025.

Featured image shows city millage rates for 2022 and 2023. Staff graphic.