Every ten years, Henry County and the four cities must renegotiate the distribution of LOST collections. But updates being provided by the cities give the impression talks have stalled. Without an agreement by year end, the revenue source will end. Residents could see a property tax increase in the thousands to maintain county and city services thereafter.

LOST Collections

Local Option Sales Tax, or LOST, represents 1 cent of the local sales tax. LOST collections then offset property taxes. The proceeds are split among the county and local cities. How those proceeds are split is based on an agreement renegotiated following every census.

In 2021, every property in Henry County received a rollback of four mills thanks to LOST collections. This equated to $162 in tax savings per $100,000 of property value. In addition, each city allocates its share of LOST collections to offset any city property tax. This resulted in three local cities paying $0 in property taxes last year to pay for city services.

The sales tax collected $51 million dollars one year ago. Under the current distribution, Henry County received 66% of the revenue and the cities split the remaining 34%. Over the next ten years, LOST collections are forecast at $627.5 million dollars.

LOST Mediation

Henry County and the four cities began mediation for a new agreement in late August. The county’s initial presentation was to receive 80% of revenues — a 14 point increase from the current agreement. The latest offer from the county was 77% county to 23% cities. By contrast, the cities’ initial offer was 34% county & 66% cities. The county rejected this thirty-two point difference. They also rejected the cities’ second offer of 57% county and 43% cities.

As of September 19, the cities had made a third counter-offer of 63% county and 37% cities. They had received no response from the county. Several cities were under the impression they would hear back following the September 20 commissioners meeting, but the board did not discuss LOST negotiations.

If the county and cities reach no agreement by December 30, then LOST collections will end. The local sales tax rate would fall from 8% to 7%. Only a subsequent voter referendum could return the sales tax collections.

Support Local Journalism

Subscribe to MHF News and support local journalism in the Henry County community.

You will receive access to all of our news articles.

Property Taxes without LOST

Because LOST collections represent a major source of revenue especially within the cities, local officials would be faced with a difficult decision without it:

- approve a major increase in property taxes,

- layoff staff and reduce services such as public safety and parks, or

- drain financial savings to cover the difference.

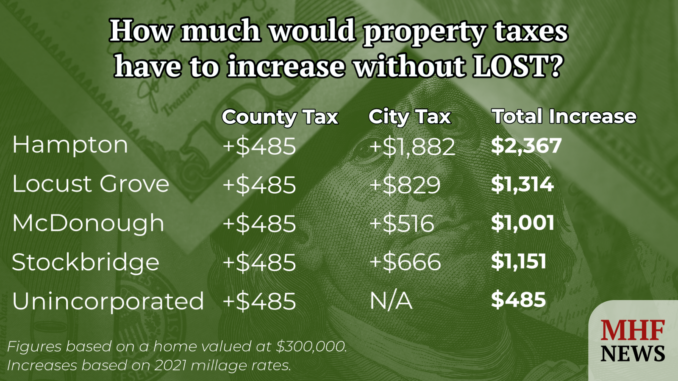

A property tax increase could be hundred of dollars, and in some instances, thousands of dollars in additional annual taxes for homeowners.

Countywide, the county would need to consider a millage rate increase of four mills to account for the difference without LOST collections. City residents would then potentially receive a second hike with additional city taxes.

Earlier this summer, the city of Hampton passed a 4.5 millage rate for the upcoming year in anticipation of receiving less LOST collections. This represents the first Hampton city property tax in decades. Without LOST collections, the city’s millage rate would need to be triple that number. The other cities would face a potential millage rate increase between four to seven mills. As a refresher, properties are charged $1 in taxes per mill for every $1,000 in assessed value.

Featured image shows chart with potential property tax increases without LOST collections. Graphic credit Clayton Carte.