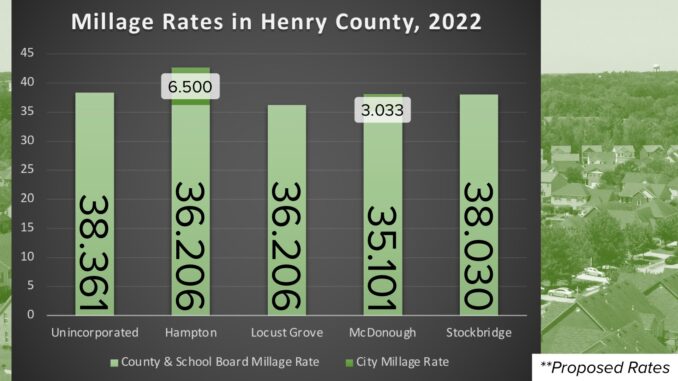

The city of Hampton announced three upcoming public hearings for the month of July 2022. The public hearings will be to receive public feedback on a proposed city property tax. The proposed city tax would cause Hampton properties to have the highest millage rate in Henry County.

Presently, Hampton does not levy a city property tax. The city council is weighing whether to implement a 6.5 mills property tax. This equates to an additional $650 in taxes for a home valued at $250,000.

Update: the city council adopted a millage rate of 4.5 mills.

Hampton Property Tax

State law requires counties and cities to hold three public hearings when setting the millage rate. Those hearing dates for the city of Hampton are as follows:

- Monday, July 18, at 9 am

- Monday, July 18, at 6 pm

- Monday, July 25, at 6 pm

All meetings will take place at Hampton City Hall. Hampton residents are encouraged to attend one of the three meetings if they would like to speak on the proposed city tax.

Tax Revenues and Budget Expenses

The proposed city tax would collect an estimated $1,754,316 in revenue. By comparison, the city’s annual general fund budget in fiscal year 2022 totaled $9.6 million.

In FY 2022, about $3.4 million of the city’s operating revenue came from LOST collections. LOST (local option sales tax) is a 1% sales tax from which the county and four cities use the collections to reduce their property taxes. Hampton and several other local cities have avoided the need for a city property tax for years because of LOST collections.

Every ten years following the census, the county and cities must renegotiate the distribution of LOST collections. Because Hampton’s population growth between 2010–2020 lagged behind the other cities, they are now the smallest city by population within Henry County. For this reason, Hampton leadership is preparing for a reduction in their share of LOST collections. City management have estimated Hampton could lose up to $1.65 million in annual LOST collections. This represents 49% of their current amount. They have proposed the city property tax to cover the forecast reduction in collections.

Negotiations between Henry County and the four cities start later this month. The new distribution for LOST collections is to-be-determined following negotiations.

Featured image shows a chart with the proposed county, school board and city millage rates within Henry County for 2022. Chart credit Clayton Carte.